tv Markets Now FOX Business December 26, 2012 1:00pm-3:00pm EST

1:00 pm

-drive the market. ♪ all on thinkorswim. from td ameritrade. dennis: you will start hearing recession will become the new bogeyman. we are already down too far. we are not going into recession. we just need to feel better. cheryl: do something. come back to washington, first and foremost. dennis: a musical about some guy singing about his real feelings. lori: we are looking at the markets. tracy: i would like to see that,

1:01 pm

but i have not. lori: i have only seen it on broadway. stalks off to a tough start. early numbers point to a tough season. tracy: a nice and shiny fiscal cliff. president obama cut his vacation short. we are tracking where it is headed next. we are expecting negotiations to continue tomorrow. there is talk now that that may not happen. time to head down to the new york stock exchange with nicole petallides. nicole: merry christmas to

1:02 pm

everybody. the vix, the fear index, has been to the upside. whether or not washington will solve the worries about the so-called fiscal cliff approaching quickly. here is a look at the dow. 13,100 even. most of the dow components are under pressure. hewlett-packard doing well and bank of america in the financial round. it really is being laid upon by the retailers. i no adam shapiro will add on to that. there is a look at some movers. michael cores down over 6%. tracy: i was in the balls this weekend.

1:03 pm

lori: crowded theater not like i thought it would be. adam shapiro in the newsroom with the details. i thought it was way busier last year than it was this weekend. >> no. here are some numbers. for the period of october to eight and december 24, sales grew. in 2011, sales for that period of time grew 2%. they are using that as an indicator that things will not be as good as we thought going into the holiday shopping

1:04 pm

season. on monday, shopper track indicated and revise their outlook for the holiday spending growth from 3.3% down to 2.5%. the only holdout is the national retail federation. it is saying that they still expect growth this holiday season to be 4.1% over the last year. they are sticking to those numbers. one of the reasons spending polls believe we saw a drop-off and had to revise the predictions for the year, superstorm sandy. they do not think it was consumers fear got as much as it was on the drops of the markets in the middle east. back to you. lori: i think they did more online also.

1:05 pm

joining us now is founder and resident of sica wealth management. this is what i am thinking about with this disappointing sales. it is so difficult for the federal government. people are wary of all of the uncertainty. they are keeping their pocketbooks closed during this all-important spending season. do you see that as an interesting perspective? >> i think at this point, here you have this santa claus rally which is a market phenomenon that makes sense until it doesn't. that works until it doesn't. coming into this season we would have a typical 1.7% increase in the s&p 500.

1:06 pm

now, we are dealing with questions that will remain unanswered until january. that uncertainty makes investors anxious. tracy: we have for trading days left. what should we be doing? what should people be doing over the course of the next couple trading days? >> i think people should really look at their capital gains. we are at a point now where capital gains is going up. it makes sense to take him and reposition them when we find out what will happen. lori: i have to tell you, i think stocks are the place to be. stocks, even emerging market

1:07 pm

stocks, there is a lot of strategy. how would you recommend it? >> i think equity because bond yields are as low as they are. there is those ocean of liquidity by the fed. it is not going into the bond market. a lot of it is going into the stock market. we have this crucial data january 8. i think if anybody will begin to accumulate bigger positions, you have to really see what will happen with earnings. lori: we are constantly waiting to see what is coming around. it is the uncertainty about the fiscal cliff. it is crazy to think that nobody knows what their tax bill for 2013 will look like right now. at some point you have to say, this is what it is.

1:08 pm

i only have so many years until i retire. risk is part of the game. this is what i am willing to invest. what is your best bet? >> there is no dow that energy stocks, to me, we are seeing the spikes in oil prices today. lori: you are basically saying try to raise some cash during this last week. that could be your fine opportunity. >> right. you have to think back at what these companies are saved. they are not overly optimistic. they were not doing back flips about the future. sometimes waiting is the best investment strategy that there is. you have to begin to see whether they will begin to grow. most companies have to face the facts. most companies are making money

1:09 pm

because of cost-cutting. i think we have to really look at ways to just be ready. the best place to be -- lori: lean and mean. cash is, well, i guess that is why you had a debate. i guess i can hold on for two weeks. >> i agree. they are lean and mean. every quarter, they are cutting more and cutting more. now, we are at the point if they are able to prove that this make sense, they will be able to show that they can grow. this could make or break a great quarter. corporations dealing with uncertainty really shows that it will either happen now or we will be in for a long call with this. lori: pleasure to have you with

1:10 pm

us. we will do a check up and see what happens in two weeks. tracy: holiday retail sales slumping. did they do better online? i am guessing, maybe. it is not faster than a speeding bullet. it is a bullet. we will show you china's longest high-speed train after this break. first, take a look at metals. we are back after this. ♪

1:14 pm

two. lori: jeff flock in the pits of this cme. jeff: we have a number of factors running today. i don't think any of them have to do with the fiscal cliff. you can see for your self the volume. there is tumbleweeds going through the pits. i will show you reasons why oil is off today. they all have to do with the middle east. suspended production with baghdad over prices. iran, to prices of military

1:15 pm

exercises. military exercises starting there today. that makes the oil market very jittery. you can see a little thin here. everything from wti to brent to gasoline futures to heating oil futures. we have a lot of cold weather coming in. a much more need for heating oil and the like. i didn't hear in that ad room. trading volume is light.

1:16 pm

tracy: so cool. jeff flock, thank you for doing that for us. [talking over each other] lori: as we do every 15 minutes, we chuckled the markets. nicole petallides on the floor of the new york stock exchange. nicole: a lot of down arrows. zynga is really bucking the trend. it is up 3.25%. it is of about three pennies. we are hearing potential for gaming in the uk. let's break it down. there is a one-year chart beard all things digital have been reporting they are close to launching games in the uk. plus poker, plus casinos.

1:17 pm

it sounds like a lot of fun. all things digital continues to take a look at online games and the potential for zynga doing exactly that in the uk. there is is up 3.25% right now. back to you. lori: great. we will see you in a few minutes. the bullet train traveling 186 miles per hour begin regular service. it previously took 20 hours and now it just take eight. in 2009 -- $640 billion is more than 139 u.s. dollars.

1:18 pm

here is to technology. tracy: eight hours is essentially new york to key west. lori: i would go like every friday. a christmas outage left millions of users without users streaming netflix. shibani joshi with this christmas debacle next. tracy: washington cannot agree on a plan for the fiscal cliff. we go to the nation's capital after break. let's take a look at how the dollar is faring against foreign currencies as we head to break. ♪

1:19 pm

with fidelity's new options platform, we've completely integrated every step of the process, making it easier to try filters and strategies... to get a list of equity option.. evaluate them with our p&l calculator... and execute faster with our more intuitive trade ticket. i'm greg stevens and i helped create fidelity's options platform. it's one more innovative reason serious investors are choosing fidelity. now get 200 free trades when you open an account.

1:23 pm

lori: the senate returns to washington tomorrow. with just five days to address the dreaded fiscal cliff. peter barnes is live in d.c. with the very latest. peter: everyone looking to leader harry reid and the president for plan c. they were discussing next steps to advert the cliff before the holiday on monday. no update today from the white house. a spokesperson for senator reid is saying "nothing to report. no conversations with republicans let." the spokesperson says "no outreach from any democrats. we are waiting on senate

1:24 pm

democrats." it looks right now that the cliff remains inside. lori: i heard you talking to dennis kneale earlier. the house generally has to post something for three days. realistically, right, everyone will come back tomorrow, they probably will not have anything by friday. peter: if they do something by friday, the house could vote on something by monday, new year's eve. the weekend could count. absolutely. they can actually do whatever they want. they can vote to waive the rules. yes, they have this three-day rule for making sure all members can read any legislation, any proposal that comes over from the senate. under the constitution, the house sets its own rules.

1:25 pm

lori: these goucher should have centered on tax policy. what is the likelihood plan from senator reed. >> $100 billion. we are waiting on senator reed. he has said that the senate legislation passed back in july, which would extend the bush tax cuts for everyone making under $250,000 a year. that that would be a vehicle for trying to get all of this done. there are a lot of other things out there like that expiring payroll tax cut. it looks like that will not get

1:26 pm

renewed. a whole pile of things. lori: a pile of what? [ laughter ] i could not resist. it is the day after christmas. >> happy new year's. tracy: it surely wasn't a holly jolly christmas for netflix users. 27 million without streaming service. shibani joshi here with the details. shibani: 27 of its 30 million customers did not have service on a knife that is very important for people. they want to watch a movie and not watch a christmas story for the 100th time. there was a blackout on amazon

1:27 pm

service. they were blocking people from getting access to movies and television shows. it was through numerous devices. there was just no way to get the context. you have to watch television or talk to your family. [talking over each other] shibani: we are finding out whose problem it really is. a lot of finger-pointing going on. this is something that has been happening a lot this year. i do not think anybody really notices just yet, unless netflix does something about it. lori: another check in the box

1:28 pm

for them. by the way, also wanted to point out amazon works a lot of different companies. instagram, twitter, etc. lori: thank you, shibani. more good news on the housing front. home prices see the largest increase in two and a half years. will 2013 be the year of the true housing recovery? tracy: first, let's take a look at some of the winners and losers on the s&p 500. netflix, apparently the investors are liking what happened. up 2%. we will be right back. ♪

1:32 pm

lori: one 30 here on the east coast. dow is down 31 points. it has been 15 minutes since we checked in with nicole on the new york stock exchange. she has a big winner. >> i feel like there is good news and bad news when you talk about research in motion. the big news is a winner past three months it has been running up certainly going into the blackberry 10 launch on january 30th. there is a lot of high hopes. we have seen one of the analysts this morning cutting the price target to the downside. that is something that we're watching very closely. bnp paribas with a neutral rating so no real conviction

1:33 pm

there. however you can see the stock is up almost 11% and with the back and forth and questions about the blackberry 10 right now a lot of believers out there. up a buck 13. nice move. back to you. lori: nicole, thank you. tracy: that is interesting when it plays out whether the blackberry 10 comes out. lori: i'm a blackberry deveto. so much easier to type on. tracy: we'll see. good news for the housing recovery. latest case-shiller report shows home prices in the 20-city index grew 4.3% year-over-year. this is despite a slip one month earlier. phoenix led cities with 1.4% gain. marking the state's 1th straight month for growth. california and new york with only two cities with negative annual returns. this morning's case-shiller housing report could be a

1:34 pm

sure sign housing strength is do we expect it to gain momentum in 2013. day one of the outlook 2013. here to kick it off, ed pinto from the american enterprise institute. ed, let's say for argument sake we go flying off the fiscal cliff. what happens to housing? >> i think housing to some extent goes off with it. we'll end up with a recession and that will dampen homebuyers enthusiasm for buying homes and we'll see a downtick in house prices and uptick in foreclosures. tracy: that is good news. let's go glass half-full. they fix this ink it. fiscal cliff solved. housing market, what, what's the big thing that you think 2013 will bring? it is the year of rental. of new construction. what should we expect to see if all goes well in washington? >> what we should expect to see is a continuation of the

1:35 pm

recovery which started this past year. you just reported that house prices are up about 4%. i'm expecting that house prices in 2013 will be up 3 to 4%. that is actually, a nice solid, steady recovery. you don't want it taking off and having increases of eight, 10, 15% because they're not sustainable. the best we can hope for is a good solid recovery. have some real positives. fundamentals are strong. house prices are down. affordability is up. rents, it cost less to own a house than to rent. the downside is we've got the government is continuing to distort the housing market and all markets for that matter and that potentially raises some red flags down the road. >> actually said that, from your notes, sewing the seeds of future disaster as long as government policies remain if place. how do we get out of them at this point? >> i think the good news for. 2012 that hasn't been reported is that the fees

quote

1:36 pm

charged by fannie mae and freddie mac are approaching, i say approaching, the level that they actually need to be to support the private sector coming back into this market. fannie mae and freddie mac have underpriced credit risk for decades, everybody knows that. and the fhfa following congress, the regulator for fannie mae and freddie mac have been raising those fees. we're now at a point where we're getting close to them being self-sustaining. in 2013 they're supposed to go up again, probably another 1/5 of a percent. that will put them at a point where the private sector can start coming back in this market. that is important because the federal government has no capital backing the 10 trillion dollar market, absolutely none. tracy:

1:37 pm

tracy: you know, ed, we have run out of time. this is fodder for another day. we have to talk about how we'll unwind this. to me that will be really ugly, fha, between fannie and freddie and all that. that could take years. >> it could take years but you have journey of a thousand miles starts with a single step. tracy: i agree. ed pinto, thank you very much. >> thank you, tracy. always a pleasure. happy new year. tracy: happy new year, ed. what a guy. he is so great. he is right, if all goes well it will be great but we've got to get the government out of the housing market. >> all right, i know. 34 tornados hit the south. at this point, why not. so look at these

1:38 pm

1:39 pm

>> i'm dennis kneale with your fox business brief. it is another down day for the marquette as washington prepares for another round of fiscal cliff dealing tomorrow. right now the dow down 33 points at 1,105. the u.s. government may reportedly expand its mortgage refinancing program to include borrowers to include mortgages not backed by freddie mac and fannie mae. the "wall street journal" reporting that the refi program under consideration could consider underwater borrowers who owe more than they're worth. that is about 11 million homes. toyota could overtake general motors and reclaim the title of the world's biggest carmaker for 2012.

1:40 pm

1:41 pm

>> 34 christmas tornados hit the south. liz art conditions in the midwest. wicked weather all wreaking havoc on travelers the day after christmas. more than 450 flights have been canceled, 500 delayed. not good news. is it going to improve? let's head to the fox weather center to check in with maria molina. maria. >> hi, lori and tracy, good to see you. you know what? depend on where you live whether or not it will be improving. if you live across areas of the south of and midwest you will start to see improvement especially as we head into tomorrow but this storm system is heading into the northeast and we'll be seeing some significant snowfall accumulations along

1:42 pm

interior sections of pennsylvania, up new york and into new england with accumulations easily over a foot especially higher elevations across that section. otherwise you just mentioned the tornados we saw across the south. about 34 were reported yesterday. today we're still seeing yet a chance for more tornadoes across eastern portions of the state of north carolina and south carolina. we do currently have a tornado watch in effect across this area until 5:00 p.m. eastern time. so the chance for more tornadoes still exist today. we have had a number of tornado warnings issued throughout the day. seek shelter if one of those warnings get issued for your county. many people don't have a basement. you have to go into most interior section of your home on the lowest level away from windows. otherwise on the western end of the storm system we have cold temperatures and snow across indiana, ohio, spreading through parts of pennsylvania. we have blizzard warnings in effect across ohio and indian in the northeast. we're not thinking too much as far as a blizzard goes.

1:43 pm

but the wind will still be gusting up to 40 miles an hour. that in combination with snowfall will produce widespread whiteout conditions as well as travel delays across the airports and roadways. we're seeing that, lori and tracy across the big airport hubs. philadelphia and laguardia reporting delays of over an hour. lori: if there is any bright light the sandy stricken areas seem to be spared. >> yes. they will get wind and rain during the overnight hours. some of those we could see winds gusting up to 60 miles an hour. so not good for coastal areas. lori: maria molina, with her eye on all things weather. thank you very much. tuesday's rare winter storms we were talking about, twisters ripped through texas, louisiana and alabama. at least three people killed. 100,000 families left without power. for more on the deadly storms we go to fox's elizabeth prann. >> we have breaking news. we heard from, they have said now six people have

1:44 pm

died as a result of all of these deadly storms. about 34 twisters spawned across the southeast and heavy gusts stretching as far west as texas. thousands of folks without power on christmas night last night. crews are scrambling to get power back to folks. parts of a severe system originated in texas and stretched east through parts of alabama, louisiana, mississippi and even northwest florida. roofs were blown off homes in mobile. really the biggest city to be hit by numerous rare winter twisters as well as powerful straight line winds. forecasters say there could have been as many 19 reported tornados that ripped through that area alone. so many folks tell us they're really shocked by the damage. >> it was a lot worse than i ever thought it would ever be, you know. it's, but it's amazing how this community, we have pulled together. they have helped me pick up the pieces and clean up. >> now trees and power lines remain down this morning. people having to sort through the debris on the

1:45 pm

roadway as these stormy conditions really continue. so officials from those impacted states are asking drivers to postpone any travel plans today. to really wait for the visibility to improve. of course today being the day after christmas means it is one of the busiest travel days of year at airports across the country. there is reportedly hundreds of flights delayed and canceled, one of them being atlanta's hub here. people who are traveling be updated on all your travel times. if you are delayed or canceled be patient. everyone is trying to get home. lori: wise advice. thank you, elizabeth. tracy: everybody be safely. it is quarter to. as we do every 15 minutes we go back to the new york stock exchange. we're watching markets with nicole petallides. you're watching energy stocks today, aren't you?. >> that's right. investors have to be patient if they're hoping for rallies here on wall street. i do want to take a close look at some of the energy names. you can see all down arrows despite the fact that oil itself is running up headlines we're getting

1:46 pm

abroad from united arab emirates and iran. energy stocks, conocophillips is down 1%. marathon petroleum down over 1%. some headlines as well. we talk about obviously the budget negotiations. that has been front and center. murphy oil says it will build more than 200 new gas stations over next two years, three years, with wal-mart, existing wal-mart super centers in the midwest and southeast u.s.. the group over all, oil services index is lower. transports are lower. here are some key names like chevron and exxon. those are two dow components also with down arrows. back to you. tracy: thanks, nicole. our guest earlier was talking about energy stocks. lori: he was hot on them for the new year. tracy: dialing up holiday sales? i sure did. shoppers putting smartphones to work this holiday season. paypal joins us with the trends. lori: we'll tell you how starbucks is getting into the fiscal cliff debate. trying to get lawmakers in d.c. to work together. before that take a look at

1:47 pm

1:50 pm

1:51 pm

happy holidays. >> happy holidays. thanks for having me. lori: shoppers are turning to the smartphones more often but are they window shopping, scanning for products sitting on the train or pulling the trigger and making purchases on their handheld devices? >> they are definitely pulling the trigger and making purchases. just four years ago mobile commerce is something that barely existed but today at paypal we're expecting to see $10 billion spent on mobile devices. not only consumers actually making purchases on those devices but they're getting more and more comfortable making more and more expensive purchases. we've seen amazing dollar apartments when it comes to the purchases. just last sunday we saw one of our top five purchases of the year, $41,250 for a watch purchased on a mobile device. >> stats you sent along for paypal spending.

1:52 pm

increase in mobile payment. black friday of this year, 193% increase. the numbers sound fantastic and we're really seeing an explosion of shopping, the cyber shopping. but again if you put it against a backdrop of the overall spending culture, people are more wary, would you agree, of opening their pocketbook overall right now? >> we are regularly seeing those two and threefold increases as you mentioned. when it comes to mobile spending the growth is still there. you did point out that retail disappointing this holiday season. when it comes to mobile and online sales. online sales according to comscore for the holiday season, november 1 to november 23rd, an increase of 16% year-over-year from last year. so we're still seeing that spending happening. when it comes to the mobile arena, flexibility, convenes, consumers are really embracing that. lori: we're throwing out a lot of figures for our viewers. 16% against historically very flat, very depressing

1:53 pm

spending culture. yes, this segment of the retail industry is growing by leaps and bounds which is encouraging but again overall for the economy is it enough to make a significant dent in actually expand gdp? >> online sales actually only account for about 10% of all total holiday sales. so as you mentioned we are seeing a decrease across the board. a lot of things impacting consumers this year. the economy, hurricane sandy, even the tragedy in connecticut, really kind of changing the mood when it came to retail sales. so overall retailers are going to see a drop this holiday season as you've been reporting. mobile helps, online helps but not a solution overall to the problem. lori: claudia, why do you think people are going and doing their shopping online versus hitting brick-and-mortar? tracy was describing her experience a couple minutes ago. the malls are a little more quiet than they were last year at this time. other than the convenes? >> well the flexibility that it offers literally, your

1:54 pm

ability to purchase anytime, anywhere, anyway. whether you're at home, whether you're on the train, whether you're in a cafe, what it gives consumers not only ability to make those purchases whenever they want but great for tools for comparison shopping. for finding great deals and promotions. you're able to do that right in the palm of your hand. you have power, basically a miniature computer that you carry with you everywhere. so you're no longer bound going into a brick-and-mortar store. lori: these are signs of the times. claudia, thanks so much for joining us. >> thank you. tracy: i shopped online. all right. well who needs washington? starbucks actually has a plan to brew a fiscal cliff deal. now in a letter to starbucks employees ceo howard schultz asked employees at its d.c. area store to write, come together, on coffee cups when serving customers thursday and friday. rather than be bystanders you and your customers have the opportunity and i believe we all have a responsibility to send our

1:55 pm

elected officials a respectful but pointed message, urging them to come together to find common ground. this is not the first time starbucks has taken a political stand. during the debt ceiling debate in august 2011, schultz made a splash calling for boycott of political contributions it u.s. lawmakers until they struck a bipartisan deal. starbucks shares at this point down slightly, 48 cents. imagine john boehner going into starbucks and they write on the cup, come together. hello. lori: boehner, this is directly to you. tracy: exactly. howard schultz is on the campaign to fix the debt. he is one of the ceos that has come out. lori: he has nothing to lose being advocate, being outspoken. the stock is healthy the company is thriving. talk about where crowds are right now, any starbucks on any corner. tracy: i hope they do it with a big black sharpie. come together. write it on the cup. lori get the latte. lori: if washington gets back together and we get a

1:56 pm

1:58 pm

1:59 pm

♪ it's so close to the options floor... [ indistinct shouting, bell dinging ] ...you'll bust your brain box. ♪ all onhinkorswim from td ameritrade. ♪ lori: a very good afternoon. 2:00 on the east coast. hope you had a wonderful christmas. i'm lori rothman. tracy: i'm tracy byrnes. we've got five days left to go. president obama cutting short his hawaiian vacation to get back to work on the fiscal cliff. you know plan b is dead. so what the heck is plan-c or is there even one at this point? lori: need a countdown clock. ho-hum, people worried about their money and keeping their wallets in their pockets. we're tracking some dismal holiday sales. tracy: plus thousands of dock workers from boston to houston threatening a huge strike as soon as this weekend. why are calling for

2:00 pm

president obama to step in. it is top of the hour. it is time for stocks as we do every 15 minutes. we head to nicole petallides on the floor of the new york stock exchange. we're starting to see the market fall down a little, right? >> we're down 36 points. the dow held the 1,000 mark pretty well here. we've had our run-up, right? for the month of december the dow still remains in positive territory though it has given back a little bit. there are concerns that are lingering pertaining to the fiscal cliff. that certainly is not going away. that remains a wildcard, uncertainty here on wall street definitely for investors but also just for americans around the country who obviously continue to look to washington to make some clear decisions. s&p 500 down about half a percent. many of the retailers are among the biggest laggards on the s&p 500. today it is sort of a christmas holiday hangover of. to a certain extent, jcpenney is picking the trend. that is up about 2%. majority of names, target, sachs, gap, to the downside.

2:01 pm

macy's is loser. how about nike? we've seen that one and gamestop also come under pressure. we got in the sales numbers we saw from mastercard pertaining to the last two months right up to december 24th. this also was a little disappointing. goes back to the recessionary levels of 2008. you see some of the names. sachs is down 4%, guys. back to you. lori: investors freak out when they see the deep discounts nicole was talking about. president obama as we were talking about is returning to washington tomorrow but with just five days to the new year is averting the fiscal cliff even possible? why not. stranger things have happened. peter barnes with the latest. peter? >> that's right. everyone looking for senate democrat harry reid and president come up with plan-c to make the next move in the standoff. they were discussing next steps to avert a the cliff on monday on christmas eve but no updates on those discussions from the

2:02 pm

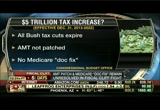

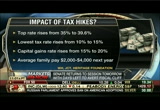

white house today. a spokesperson for senate majority leader harry reid says quote, nothing to report. no conversations with republicans yet. senate republican leader mitch mcconnell who can filibuster anything reid proposes, his spokesperson saying quote, no outreach from any dems. we're waiting on senate dems. so, if nothing is done, that means on january 1st, the nation faces about a five trillion dollar tax increase over 10 years through the expiration of the bush tax cuts and assuming congress does not approve its annual patch for the alternative minimum tax and that medicare doc fix that prevents deep cuts in medicare payments. now the lapse of the tax cuts would mean that the top tax rate would revert back to 39.6 from the clinton administration from 35% now but taxes would also go up for lower income earners. the maximum low rate would revert back to 15% from 10% now. the for investors, capital gains rates would revert to 20% from 15% now.

2:03 pm

depending on the analysis, the average family would pay 2,000 to 4 thou more in taxes next year. back to you guys. tracy: peter we were talking about the protocol. you sent a great little ted it about. you have to explain it to the viewers. the house makes these rules, three day rule everyone gets opportunity to read but the house has the opportunity to throw them out of the window. >> that's right. the house can waive its rules so they can waive the three-day rule, but, also the three days isn't 72 hours now. it is like, it's three calendar days. if they post it one minute before midnight on one day, then have it for 24 hours for day two, they can post it for one men on day three, that apparently now counts as three-day rule. so 24 hours and two minutes. tracy: it's a joke. sound like my house. i make up the ruse as they go. lori: whatever, mom. tracy: that is not what you said yesterday. peter barnes, thank you very much.

2:04 pm

>> all right, thanks. lori: fascinating how peter listed the tax increases. that's a serious quality of life change. tracy: less vacation for -- $2,000 it's gone. >> personal income. family, businesses you name it. i definitely see where the cbo is coming from talking about recession here. tracy: you will start to feel it quickly. let's talk more about it. joining us with more on the fiscal cliff, peter morici, professor of business at the university of maryland and former chief economist for the u.s. international trade commission. peter, play it out for us. let's presume we're going over the cliff, what happens? >> are we going over the cliff or are we bungee jumping? going over the cliff for good or president expect to get this all patched together by january 15th. tracy: good point. >> if we're going over for good, we'll not just have recession. cbo being what it is can not talk about how bad it will be. if we raise taxes this much don't cut spending a peter described don't do anything

2:05 pm

about it, we're looking at recession that takes unemployment into the teens. at those kinds of levels it is difficult for economy to recoup and recover. tracy: peter climb into the weeds here for us. peter gave us the update where we are, sorry, senator reid, now all the focus falls to him. do you think he can craft a package that will make any headway at all? >> well, it is a very interesting problem because there are moderate republicans that might be inclined to vote for an extension of the bush tax cuts the way the president likes it, that is, on incomes of up to $250,000, simply to avoid going back to their districts and say, gee whiz, i didn't want to impose this big tax increase on you. so therefore i had to compromise. however the tea party folk don't want any part of that. and that would put mr. boehner's speakership in vulnerable position. let's face it, mr. boehner is worried about the country but most of all worried about mr. boehner. tracy: right, exactly.

2:06 pm

peter, i love your analogy we could go bungee jumping because i think at end of the day that is what happens, right? they will make everything retroactive. what does that do to the economy or at least people's psyches, very well be the first month of the year? >> if it is a whole month it is not bunge jumping. we're off the cliff. they have to have a deal in sight or people will start to change their behavior in two ways. they have less money to spend. if you think folks lack confidence in washington now, if they can not resolve it and no liz solution in sight, consumers won't have much confidence in washington and investors may start getting shaky about u.s. bond. tracy: peter what is the time frame, what do they have? do they have a week into the new year? two weeks before all hell breaks loose? >> it depend whether in the first week they have the makings of a deal and matter of just getting it through so by the 15th we're done. if we get up on the third and where we are now, then i suggest we have gone over the cliff. lori: you mentioned

2:07 pm

shakiness in u.s. bonds, yields are down again today, peter. there is no message from the market. >> i understand that. but it will be rocked along for a very long time. lori: why are we not getting a stronger message from the market so -- where are the bond vigilantees to get washington to act? >> quite simply, europe looks so bad where would you put the money? alternative to --. lori: talking about that for a year now. there is no interest payment in u.s. bond. u.s. stocks are really a better return right now. >> well they are right now but if we go over the cliff you might not want to repeat that statement. cash might, a lot of people are going to have to move to cash if they really feel shaky about the u.s. government. but gold. we might see a boom in gold. lori: buy up that bullion. bury it in the backyard. real hard asset. >> just like french farmers. lori: no kidding. tracy: peter, you're great. have a happy new year. >> happy new year, friend. lori: i wasn't arguing with him. i was agreeing with him. tracy: you're question is a

2:08 pm

good one. where are the bond vigilantees? they have been gone for months now. lori: for years. tracy: for years, you're right, my goodness another housing bailout, the government backing up a plan to bail out underwater homeowners that may ultimately leave you on the hook. tracy: let's look how oil is trading as we head out to break. it is up almost 2 1/2%. $90.75 a barrel. we'll be right back.

2:12 pm

>> get this. the government's housing bailout may get bigger. the white house is backing a plan, shaking your head understandably so, backing a plan to help underwater mortgages in a big way. liz macdonald with more from emac's bottom line. what is this? >> this involves getting fannie mae and freddie mac which taxpayers own to back basically mortgages that are, what is called negative equity, meaning they're underwater and they're not already insured or guaranteed by fannie mae or freddie mac. so here's the plan now being floated behind the scenes at the white house. essentially says that if you owe more on your mortgage than your home is worth, and you essentially are current in all of your loan payments at five years or higher, meaning current for five years or more, you can refinance to a lower mortgage rate. the lower rate mortgage though would be backed by

2:13 pm

fannie mae and freddie mac with higher fees from those two. so that's the name of the game. in other words, fannie mae and freddie mac would get to charge higher fees and higher rates. the banks are saying, if these loans are belly-up, we don't want them back on our balance sheet. that is only way we go along with it, tracy and lori. this is part of the name of the game. essentially freddie mac and fannie mae are supposed to be run at shareholders but now being run at expense of taxpayers. tracy: that is total backwards thinking. why do we continue to perpetuate the problem? we had ed pinto saying from american epenterprize institute saying we have to get government out of the housing market but now we're doing putting it in further. >> i think name of the game is put housing off the necks of the american consumer. that is what the administration is thinking. put it on the government's books. this is part of a never

2:14 pm

balancing the budget act in washington, d.c. freddie and fan any are run by one giant housing program, when their overseers, federal housing finance agency suing banks to put more loans back on their books away from fannie and freddie. this could reverse the trend. lori: like a kitchen sink proposal? >> could be. that is great question. we have 3.7 million homes in so-called shadow inventory, mortgages heading to foreclosure. this on the heels of the administration's failed attempt to get loan modifications meaning principle write-downs right? let's do more refinancing of negative equity underwater mortgages that are basically subprime. a lot of them are subprime. lori: agree, get government out but not until we get the problem pushed aside with underwater mortgages still plaguing economy. >> nearly four million homes, wow, that is lot. could they end up in fannie and freddie, remains to be seen. congress still has to weigh in. they may not go for it. tracy: let markets work it

2:15 pm

out, lizzie mack. thank you. retailers, manufacturers and farmers are bracing for possible strike. lori: no way. tracy: right. that could shut down ports from boston to houston. 15,000 dock workers are preparing to strike after this weekend. after contract negotiations between international longshoremen's union and shippers broke down. groups are calling on president obama to step in, believe it or not to avoid billions in losses. they're citing a 2002 lockout at west coast ports, at west coast ports that caused the economy one billion dollars a day. this is after a push by federal mediators, the two sides agreed to come to the table again. no word when those talks are scheduled. the only up shot to the whole thing, lori, the big shipping season is over. lori: that is one of the mitigating factors. tracy: it might not be as damaging to the economy. we're talking about royalty fees here. lori: we're talking about royalty fees. a union story.

2:16 pm

union having more of an influence given size of this economy and industry. this is what the critics are saying about it. more big bad union news there for you. let's check the markets. stocks are off the worst less of the session. let's check in with nicole on the floor of the stocks he can changes. you're looking a couple names on the move today. >> we're looking at a couple movers. we're off session lows. i see drug index and banking index actually have green arrows now. let's look at herbalife. that is name we focused on since last week. dropped 12% last friday. had 19% loss. today getting a pop back up. bill ackman of pershing talking about the fact he thought it was a pyramid scheme. he had a lot to say in a negative way of herbalife. now reportedly working with a law firm on this so obviously you can see here right now is up about 7%. herbalife obviously says his whole attack is malicious and without basis. we'll look at apple.

2:17 pm

apple on the move, one of the big tech movers. in this case a tech mover to the downside. tech-heavy nasdaq has been down half a percent. apple is down $4.54 at 515 and change. certainly, lori and tracy, nowhere near that $700 it was in the middle of september when we were talking about 800, a thousand. now everybody is hoping it holds the 500 mark. lori: you can't dip your toe into apple because even at 500 bucks a share it is still pretty rich. >> everybody still wants the product. it's a holiday gift. >> you hit the nail on the head nicole as always. back again in 15 with you. we were talking about this a little earlier. starbucks is urging washington to come together on the fiscal cliff literally. we have video from d.c. starbucks ceo howard schultz telling employees at all washington area stores to write, come together, on all customer cups tomorrow and friday as politicians turn to capitol hill to deal with the fiscal cliff.

2:18 pm

the cup campaign aims to end send a message to politicians to serve as rallying cry in the days leading up to the fiscal cliff deadline. do you think you will get action by signing on a coffee cup? is this really for me? is this message really for us? tracy: i think it is a mandate from the ceo down to these, you know, stores. that is pretty big actually. lori: i mean they have a lot to lose or stand to gain depending on the tax changes. tracy: you start cutting a little money out of my paycheck i make my coffee at home. lori: that is great point. what are the chances that america goes over the cliff and our credit rating gets downgraded? the reality ahead. tracy: first here is how the dollar moving against its foreign currencies right now. we'll be right back

2:19 pm

but we can still help you see your big picture. with the fidelity guided portfolio summary, you choose which accounts to track and use fidelity's analytics to spot trends, gain insights, and figure out what you want to do next. all in one place. i'm meredith stoddard and i helped create the fidelity guided portfolio summary. it's one more innovative reason serious investors are choosing fidelity. now get 200 free trades when you open an account.

2:20 pm

executor of efficiency. you can spot an amateur from a mile away... while going shoeless and metal-free in seconds. and you...rent fm national. because only national lets you choo any car in the aisle...and go. you can even take a full-size or above, and still pay the mid-size price. now this...will work. [ ale announcer ] just like you, business pro. just like you. go naonal. go like a pro.

2:22 pm

2:23 pm

afterwards. >> yeah. maybe take the item say i will return it unless you give me discount. tracy: that is true. you can do that. >> sachs cut up 70%. kennett cole 30 to 60%. this is what mastercard is telling us. they expect from october 28th to december 4th they said sales this year or last year only grew .7 of a percent. for 2011 for same period of time of time, october 24 to december 28th, sales grew by 2% over 2010. this has a lot of people worried. it is hitting some retail stocks today. as we look at people that are shopping keep in mind the national retail federation predicting this holiday season which isn't over yet, this holiday season will be on par of growth 4.1% last year. $586 million season. we had revisions. shoppertrak was expecting 3.3% growth over last year.

2:24 pm

they revice i had to 2.5% because of that period of time of time shoppers didn't head to the storm. why, were they afraid or superstorm sandy. tracy: you said head to the storm. >> maybe i'm tired and need a glass of wine. tracy need as glass of red. here is the bottom line, according to spending pulse, you do need a glass do you. tracy: i am sorry. >> what you learn in commercial break. bottom line it really wasn't that consumers are afraid. it was super storm sandy hit the markets that had such a negative drag because people weren't shopping on the overall picture, on the east coast, it pulled it down. so blame superstorm sandy. if it is worse than everyone is predicting then perhaps you could blame the fiscal cliff. lori: i think adam might take you out for glass wine after the show. >> we could drink. tracy: we should go shop first, really good sales. >> probably line. there are good sales online. tracy: learn so much about your colleagues. love it.

2:25 pm

lori: so what happens to america's credit rating if we do go over the fiscal cliff? you will recall last year's debt ceiling debacle resulted in standard & poor's stripping the u.s. of its top rating and now fitch is warning of a possible review. joining us now to discuss this possibility and the ramification senior editor with "the national review" and former campaign manager for dick gephardt's presidential campaign. welcome to you both. ramesh i begin with you. one. topics lost in the shuffle in the fiscal cliff negotiation we're perilously close to running up against the debt ceiling again. what do you think should happen with the debt ceiling? are you really all that worried about the another debt downgrade since the first one didn't too much to roil markets? >> i think it is important that the debt limit get raised but at the same time i think it would be advisable to while we're doing that, look at the drivers of our exploding debt and do something to reform that. i don't think that the credit rating should be the

2:26 pm

focus of debt ceiling talks because just as you pointed out, you know, the credit rating is just the opinion of the credit raters and it didn't seem to have all that massive an impact if you look at the stock market or interest rates or employment. the downgrading of the credit rating doesn't seem to have had any effect. lori: but, steve, we have the debt ceiling for a purpose, right? to avoid overspending. yet it doesn't seem to be doing its job. how can we get meaningful spending cuts, preserve entitlements back into the dialogue of this fiscal cliff debacle? >> well, i don't think we have it to encourage fiscal responsibility so much as we have it because it's required for congress to authorize borrowing money to pay our debt and deficit obligations. it's, the way i look at it, it is a mere constitutional technicality and we should raise it. i would like to make one point about on the downgrade issue that he just talked about. if we go over the fiscal

2:27 pm

cliff, that would certainly be no reason for a downgrade because we would be cutting the deficit and the debt. lori: right. >> but if we kick the can down the road here and don't do anything with a short-term solution, then i think it would be reasonable for the debt, excuse me for --. lori: another downgrade. >> for us to be downgraded, excuse me. lori: let me send it back over to you. there is a line of thinking if we do suffer a second credit downgrade that it could actually have more of ramification than just one downgrade because you do have a handful of credit agencies, right? if you're creditor of the united states and looking at the credit rating and now you have not just one but two, so you have a majority of more negative credit ratings versus pristine credit rating across the board, that actually might roil the markets. obviously you have europe in the background so that is keeping rates depressed as well as federal reserve. the second downgrade, that really has to raise the

2:28 pm

eyebrows of market participants in particular? >> i think people have gotten sophisticated about opinions of credit ratings agencies last several years and what they fail to be and how much their opinions are worth. you have got it right in your question in that, you've got to look at the international context and where else are people going to make investments where their money is more secure? right now it is not looking like there are a lot of places. lori: yeah, unfortunately that is the case. steve, i want to kind of shift the conversation a little bit here. we talk about spending and what atters most, the entitlements, social security, medicare. what's the right balance? what is the property safety net? how do you want to see this all unfold here? because we do have to reserve government spending for these things? >> social security doesn't belong in the conversation because social security is solvent. it has been enloing money to the federal government that the federal money owes back to social security just like it owes all the rest of our

2:29 pm

creditors. leave social security out. medicaid is mostly for children though we have a problem with senior citizens and in long-term nursing home care financed through medicaid. that needs to be addressed but the big problem is medicare. we do have to do something about rising medicare costs. now republicans talk about completely privatizing it. democrats talk about doing nothing. neither one of those is viable option. they have got to get together and come up with some ways to slow the growth in medicare spending. lori: i don't have a lot of time. i want to get to your last comment how you see the ultimate ending to the fiscal cliff? >> well i think we're going to go over the cliff. i think that taxes are going to rise and spending will start automatically getting cut at beginning of january. and then, give, depending on the public reaction you might get a deal. but i'm pretty pessimistic, have been all month whether a deal will be made before the end of the year. lori: ramesh, and steve, thanks you both chiming in. appreciate your take on these topics of the day.

2:30 pm

>> thanks. lori: reality is sinking in with just five days to go before we go over the cliff or maybe we won't. how are americans feeling? the latest poll numbers and gerri willis next. tracy: people are waking up finally. we'll tell you which industry stand to add and stand to lose the most jobs in 2013. let's take a look at some of today's winners and losers as we head out to break. the dow down 25 points. jcpenney is your s&p 500 winner, up 3 1/2%. we'll be right back.

2:34 pm

snowing a little. it's seasonal. typical winter. it's officially here; right? >> yeah, i'm all about the beach and whatever. >> i know. >> bikinis and forget the snow boots. >> my kids went skiing yesterday and had a blast. to each its own. the dow's off 29 points. we are on the floor. >> i love the beach. i switch from skiing to snowboarding because hi kids said i was not cool on the skis. tough talk. here i am with ben willis, and we talked about the market, but the number one question, what's everybody saying about the fiscal cliff? >> new year's resolution is never to have to say those words again. >> oh, come on, what do people think? what's the reaction in the market? >> traders are tired of the hold. what you are witnessing now is political theater. the president getting on the plane, coming home early, on and on, just get it over with.

2:35 pm

that's what you are elected to do. just do your job. we're tired of it. >> pushed back into january? >> may have patch work done causing a resolution, but the market continues to say we believe it's going to happen because the fact of the matter is if it doesn't happen, the market turns ugly really fast. >> all right. there's obviously the belief something's got to happen but better be sooner than later. >> ben's got to have a better new year's resolution than that. >> i like it. that and eat more broccoli. >> he's laughing because it's the truth. >> thank you, nicole. >> i have to think of the new year's resolution. >> that's one of them, never to say that again. five days to go before we go over the fiscal cliff which i'm not saying after january 1st, americans are concerned about the threat. 50% of the surveyed believe we'll get a deal. 48% say that we're going to run out of time. there's a big chance -- that's a

2:36 pm

change from ten days ago when 57% thought we'd have a deal and 40 #% thought it was over the cliff. gerri willis is here of "the willis report," why are we just now waking up? >> if you were somebody who didn't have to talk about the every day, would you pay attention to it whatsoever? i don't think so. people are just tuning in. the question is, of course, like what can we do about it? right now, the president makes his way back from hawaii today and tonight. the house, we don't know when they are back. boehner is stuck in a blizzard in butler county ohio and don't know when he'll be back. more details from the survey which is interesting. 68% of those polled said negotiators should compromise and 22% said stick to your principles. interesting people are weighing in on this and starting to think about this as we approach the deadline. >> the policies are fascinating,

2:37 pm

democratic handling and waning on the republican negotiators. >> we knew the republicans would be blamed for the cliff. that's been clear. poll after poll shows that. >> holidays are over. we've gotten through that and now we pay attention to what's going on, and, man, it's ugly. >> i have my husband's birthday to get through. the beat goes on. >> christmas babies get gypped. i feel bad. >> yeah. >> what are you talking about tonight? >> about this, grover norquist to talk about it. >> love him. >> he's got to be annoyeded. >> on where is the commonground. >> thank you, ger. crude at $90.98 a barrel, up $2.37 a barrel. weaker dollar adding to that too. you saw the pictures on the eastern sea board, middle east headlines pushing prices higher. reports say that iraqi kurds

2:38 pm

suspended production by 180,000 a day. that's going to be bullish news there on the price of crude. >> a lot going on, and not all the fiscal cliff i should say, thankfully. what it means for you and your taxes. you got to hear this. >> forget holiday cheer, the top box office winners ahead. as we do every day at this time, favorite time of the day, the bond yield. there's the ten year. the perceived security of u.s. debt, the long bond. back in a moment.

2:39 pm

2:40 pm

over year. chicago and new york the only cities with annual negative returns. there's a deal with walmart to build gas stations at more than 200 walmart stupe centers in three years focusing on refail businesses. two months ago, murphy oil approved a spinoff of the american fuel making and distribution business into a new company. cable vision filed a lawsuit against the communications workers of america for making false claims about internet service in brooklyn, new york. the cable giant alleges the district of one and local 110 # 9 engaged in unlawful campaigns to discredit the cable business. that's the latest from the fox business network giving you the power to prosper.

2:41 pm

2:42 pm

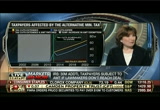

bills go up and the next guest says middle income earners hit the hardest. a partner at my al m matter. glad you are here. >> thank you. >> we are at the same place every year, begging for a patch from congress. my theory is this is their way to push us into a flat tax system; right? >> you're correct. the amt is a different way of calculating the tax, taking your income saying we're not giving you many of the itemized deductions and have a different rate. there's been consistently an exemption amount which requires congress to pass a legislation each year to extend it. the exemption is not permanent in our tax code, and right now, it expired going back to january 1st, 2012 so we don't have it right now. >> do you think they could let it go? it's close. in prior years, we had the patch

2:43 pm

earlier on. >> absolutely, and the irs planned op the patch, and the computers are program the that way. if we don't get it, it not only impacts those who have to pay the amt, but delays refunds because the irs computers have to be reprogrammed. we slotly need the patch and quickly. >> at the same time, though, as dire as it has, they could pass the patch, and say january 15th, make it retroactive and we're fine. just delays the process. >> that's right. until the irs and people know whether that patch is there, you can't file a return and get a refund or do anything. >> talk about the fiscal cliff. what happens to my paycheck? we know the social security -- our social security is going up on the payroll taxes, but what else happens? just my w-4? >> depends on your personal situation so the change in the social security tax will automatically happen in your

2:44 pm

paycheck, but other things happen dependent upon your own family situation. if you make more than $250,000, you will have -- you'll have an incrementally higher fica that's unlimited. that's a .9% that your medicare tax essentially goes up. >> into the w-4 table? >> the w-4 tables if you personally make more than $200,000. once wages hit $200,000, the employers take it, but if you are filing jointly, gross income of $250,000, you are subject to the tax, but the employer may not know it because they don't know your family situation in which case you have to plan on increasing your withholding through the w-4 or making quarterly estimated tax payouts. >> oh, what a great point. we have to run, but quick, you specialize in private equity. do they lose the 15%? >> carried interest on the table for a long time. >> probably going to lose it,

2:45 pm

aren't they? i know, i know, you can't say. thank you so much for being here. >> thank you. >> i'm telling you, that's -- >> you're talking to a private equity household here. >> i know you are. >> what camera am i looking at. i'm hot and bothered. folks may not have hit the stores on theaters, but millions for the box office. dennis? >> the box office offered a bizarre clash of tastes. yesterday, a sap pi broadway musical pitted against a violence r-rated western from cold film director, and the big surprise is the sappy musical won. lemiz took it, and d'jango was second place at $15 million.

2:46 pm

both films surprising to the upside. the fox film "parental guidance" with a 7 million bucks christmas day. there's good and bad news. be proud that d'jango broke the record for an r-rated film besting aly or be embarrassed that had got its keester kicked by a musical. your call. for the weekend box office leading up to christmas, "the hobbit" with another $37 million. the tom cruise vehicle "jack reacher" second over $15 million, and three other film rounding out the field there, but the musical is the biggest story. good news for comcast universal studio hoping to surpass another musical "mama mia" with $600 million worldwide in 2008. if they do that, yiewn universas

2:47 pm

anything but miserable. >> that's a classic. >> one of the greatest broadway productions ever. >> and one of the sappiest. >> sunning voices. amazing. >> and "mama mia" as a movie was cheesy. >> but it's more fun. >> what's your favorite christmas movie? >> "a christmas story" with ralph and the bb gun. >> of course. >> we watched tim allen and "the santa claus," i love it. >> dennis, you're great. >> thanks. >> time for stocks as we do every 15 minutes, nicole's on the floor of the new york stock exchange. what's your favorite movie? >> got to love the christmas spirit, all the cartoons, they are a lot of fun. i don't know. any one of them, and i'm in. sign me up. such great christmas spirit. i have 20 tell you talking about movies, a great segue into

2:48 pm

netflix, preparing to sit down on christmas eve and watch their favorite christmas movie orphan netflix and couldn't do that because the web server from amazon, there was an outage so it went from christmas eve, in some cases, through christmas day. netflix users could not watch streaming movies and not on the console, nothing. there's a look at am zone, down 4 #%, back to you. >> and we watchedded "the polar express," like, 4,000 times. >> the claymation movies freak me out. >> like the old ones, frosty? >> yeah. >> oh, no, no. are you looking for work in all the wrong places? well, we have the best and worst industries to find a job in 2013 next. >> plus, oil up big today, weaker dollar, live in the cme next going to break, a look at

2:49 pm

the gaffers, if you will, winners and losers on wall street. we're back in a moment. she knows you li no one else. and you wouldn't have it any other way. but your erectile dysfunction - you know, that could be a question of blood flow. cialis tadalafil for daily use helps you be ready anytime the moment's right. you can be more confident in your ability to be ready. and the same cialis is the only daily ed tablet approved to treat ed and symptoms of bph, like needing to go frequently or urgently. tell your doctor about all your medical conditions and medications, and ask if your heart is healthy enough for sexual activity. do not take cialis if you take nitrates for chest pain, as this may cause an unsafe drop in blood pressure. do not drink alcohol in excess with cialis. side effects may include headache, upset stomach, delayed backache or muscle ache. to avoid long-term injury, seek immediate medical help for an erection lasting more than four hours. if you have any sudden decrease or loss in hearing or vision, or if you have any allergic reactions such as rash, hives, swelling of the lips, tongue or throat,

2:50 pm

2:52 pm

>> oil soaring to a two month high. jeff block in the pits of the cme. hey, jeff. >> the tour continues in the cme, by the way, this is the bonds, the treasury bond, the 30-year bond fit, the 10-year, and behind me, the two and five year bonds option pitt this that you see, but, no, it's not the story today. bonds not the story, something you never see, but, oil, look at the numbers, oil up 2%, wti and brent up today and the reason is middle east. military exercises by iran

2:53 pm

taking place near the straits of hormuz, and, also, iraq, a cut in production in iraq. heading towards the s&p pit, the oil complex today. it's not just crude oil up, but all oils. heating oil, gasoline, everything. i leave you with a shot of the s&p pit up this stairs here. there you go, folks. >> so great. thank you for the tour. >> thank you for the tour, love it. >> thanks, jeff. >> as we avoid the fiscal cliff and the economy picks up, and big ifs, which industries stand to add the most job? rick newman is here for u.s. news and world report. rick, nice to meet you. >> hi, how are you doing? >> you gave us a list, and interesting to pull out the theme. social networking sites, video game publishing, online payment, definitely a theme here where the growth is at. >> heard this the last couple years, obviously, it's digital, digital, digital, and real

2:54 pm

estate on the list as well. social networking. it's not a 235d, but -- a fad, but here to stay, and mobile devices, social networks follows. news sites too, not just facebook and twitter, but pinterest. there's smaller ones, niche sites, but the trends is here to stay. >> sustainable building materials, huh? >> i hate to tell you, but it's growing, and it is growing because state and local governments have new standards, not because of washington, anything happening in washington. it's not a stimulus plan, don't worry, but it's new standards. state and local governments needs buildings to be energy first time in their own buildings too; plus, real estate is coming back so there's construction going on. >> what's interesting in the patterns is the industries growing are growing at a much faster rate than the industries with jobs that are shrinking, if you will. for example, social networking

2:55 pm

up 51 mc, photo finishing down only 15%. >> yeah, i think that's because we have a lot of industries that are stagnant or declining, and we have only a few that are really growing, but those are the ones growing by quite a lot, and it's mostly the technology industries, but the list -- these are industries lanked by the number of jobs to be lost, by the way,. photo finishing. we know the story, the flipside of what we heard about. instagram, it's not a camera to be printed out and brought home. it's industries that show up on the list of declining ones that are kind of losing out to technologies. >> that's a lot of it; right? , you know, beer, wine, liquor stores, order online. flag, performance theaters, you can watch online too now; right? >> yeah, and people -- for beer and wine, it's beer and wine stores. people are actually going out to restaurants more because the economy's recovering, so in a way, it's a good sign. they drink less at home, meaning

2:56 pm

they do not buy as much at the store. tobacco is another one going down. it's interesting. tobacco sales actually went up in the recession. the theory there is that stressed out people, afraid of losing a job or lost their job smoked more. >> i know a few of them. >> i think we've seen some of them around here; right? on the streets around here. now we have the inverse of that, people going back to work, less stressed out. >> and the data -- oh, we have to wrap up, a quick answer, if you will. is this where to send your applications to? >> yes, i suppose if you are in the right place, happen to be in california, and the technology companies are there, sure. but people are are not in the right place with the right skills, still a problem people have in 20 # 13. >> hopefully you can work remotely. >> great stuff, rick. >> thanks for having me. >> ashley webster takes us to the last hour of trading on the day after christmas. james moffit is putting money to work in european multinationals

2:59 pm

♪ [ male announcer ] this is karen anjeremiah. they don't know it yet, but they' gonna fall in love, get married, have a couple of kids, [ children laughing ] move to the country, and live a long, happy life together where they almost never fight about money. [ dog barks ] because right after they get married, they'll find some retirement people who are paid on salary, not commission.

182 Views

IN COLLECTIONS

FOX Business Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11